Maryland Tax Form 2025. 27 rows the chart shown below outlining the 2023 maryland income tax rates and. You can quickly estimate your maryland state tax and federal tax by selecting the tax year, your filing status, gross income and gross expenses, this is a great way to.

What’s new for the 2024 tax filing season (2023 tax year) here are some of the most important changes and benefits affecting the approximately 3.5 million taxpayers working on their 2023 maryland income tax returns. Enter your details to estimate your salary after tax.

In Fy23, 6,004 Eligible Renters Received An Average Of $450 In Tax Relief.

Use our income tax calculator to find out what your take home pay will be in maryland for the tax year.

Maryland Income Tax Form Instructions For Corporations:

The extension deadline is november 15, 2025, to file your maryland s corporation &.

Maryland Tax Form 2025 Images References :

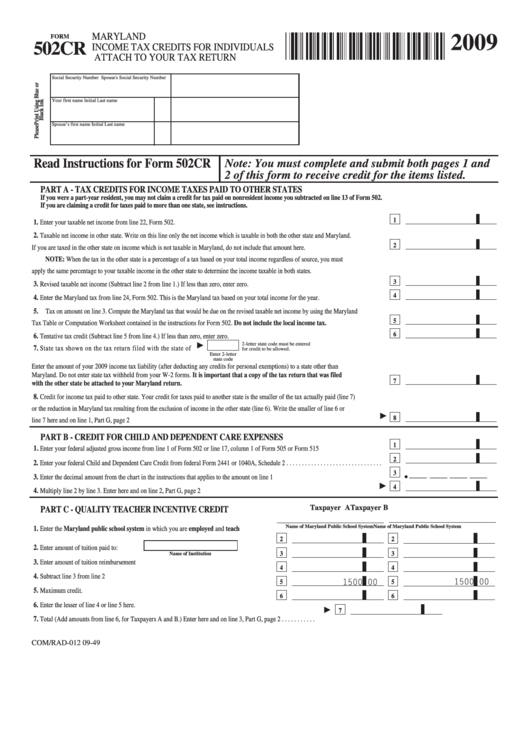

Source: printableformsfree.com

Source: printableformsfree.com

Maryland Online Fillable Tax Forms Printable Forms Free Online, If you make $70,000 a year living in kentucky you will be taxed $10,985. Instructions for filing corporation income tax returns for the calendar year or any other tax year or period beginning in.

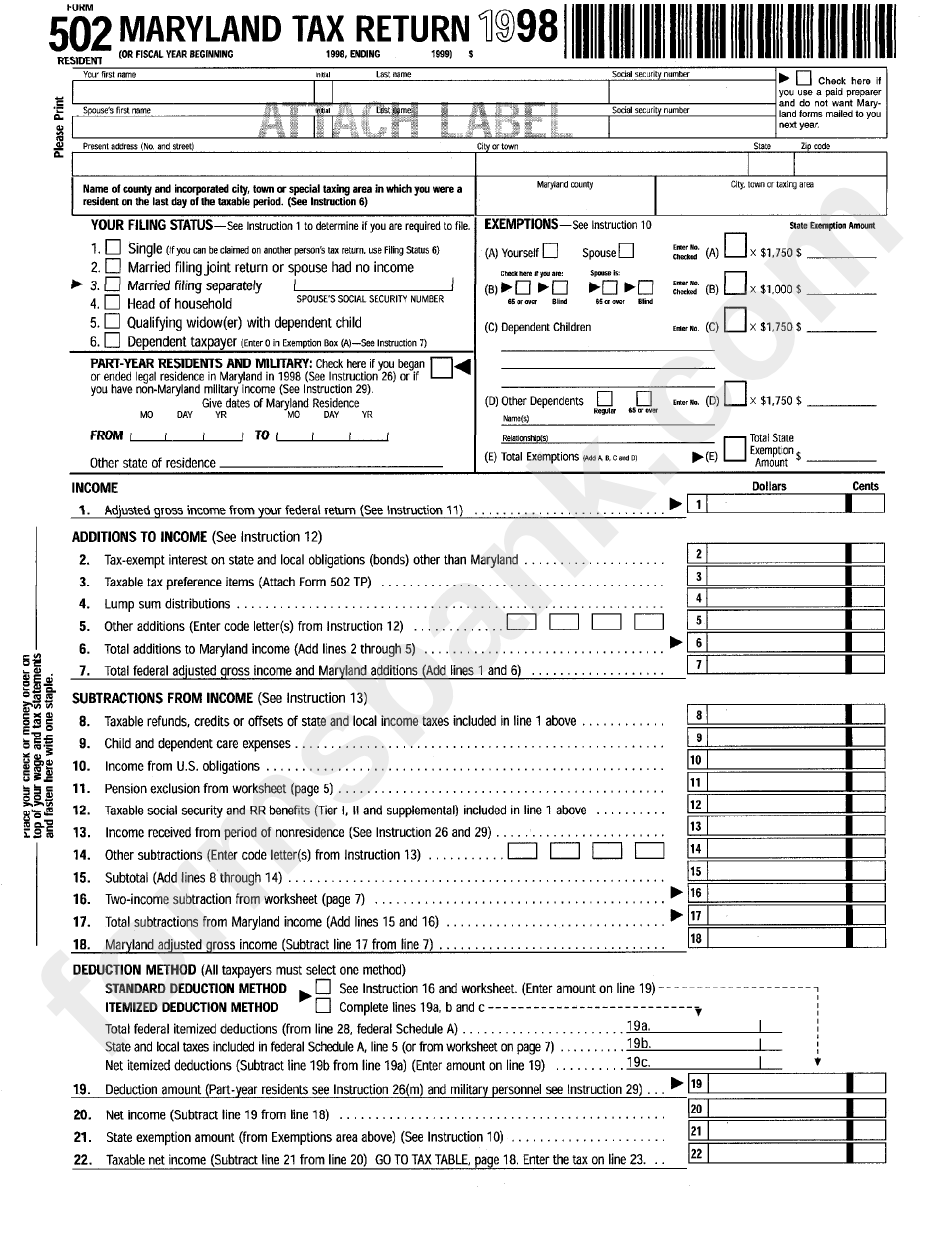

Source: printableformsfree.com

Source: printableformsfree.com

Maryland State Tax Fillable Form Printable Forms Free Online, All marylanders who received a homeowners’ or renters’ tax credit in 2023 will be mailed. Calculate your annual salary after tax using the online maryland tax calculator, updated with the 2024 income tax rates in maryland.

Source: www.employeeform.net

Source: www.employeeform.net

Maryland Employee Tax Forms 2024, All marylanders who received a homeowners’ or renters’ tax credit in 2023 will be mailed. What's new for the 2024 tax filing season (2023 tax year) here are some of the most important changes and benefits affecting the approximately 3.5 million taxpayers working on their 2023 maryland income tax returns.

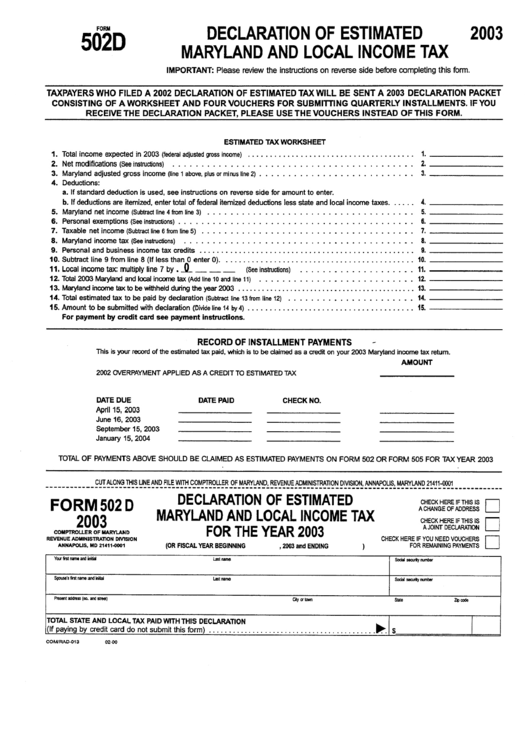

Source: jereqmaegan.pages.dev

Source: jereqmaegan.pages.dev

Md Estimated Tax Form 2024 Kirby Carilyn, You can upload, complete, and sign them online. Did you know you can file an admissions & amusement tax, sales and use tax and withholding tax return and make a payment without logging into your account?

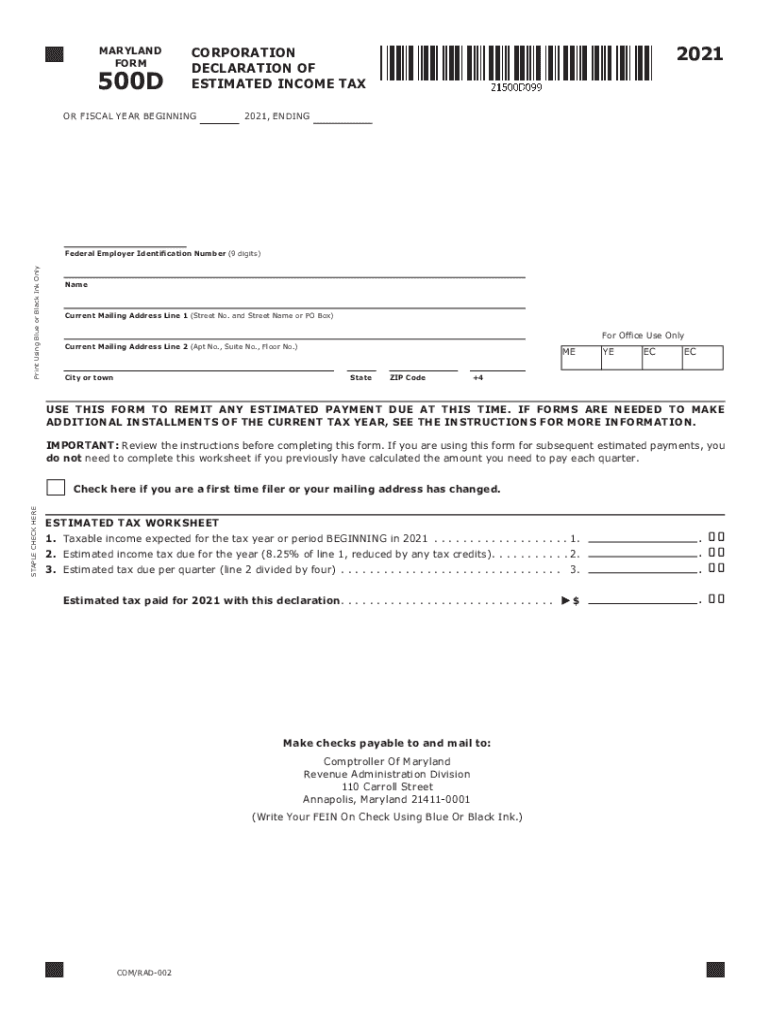

Source: www.signnow.com

Source: www.signnow.com

Maryland 500 D 20202024 Form Fill Out and Sign Printable PDF, You must send a payment for taxes in maryland for the fiscal year 2024 by april 15, 2025. 27 rows the chart shown below outlining the 2023 maryland income tax rates and.

Source: www.withholdingform.com

Source: www.withholdingform.com

Maryland Non Resident Withholding Tax Forms, Use our income tax calculator to find out what your take home pay will be in maryland for the tax year. You can quickly estimate your maryland state tax and federal tax by selecting the tax year, your filing status, gross income and gross expenses, this is a great way to.

Source: www.signnow.com

Source: www.signnow.com

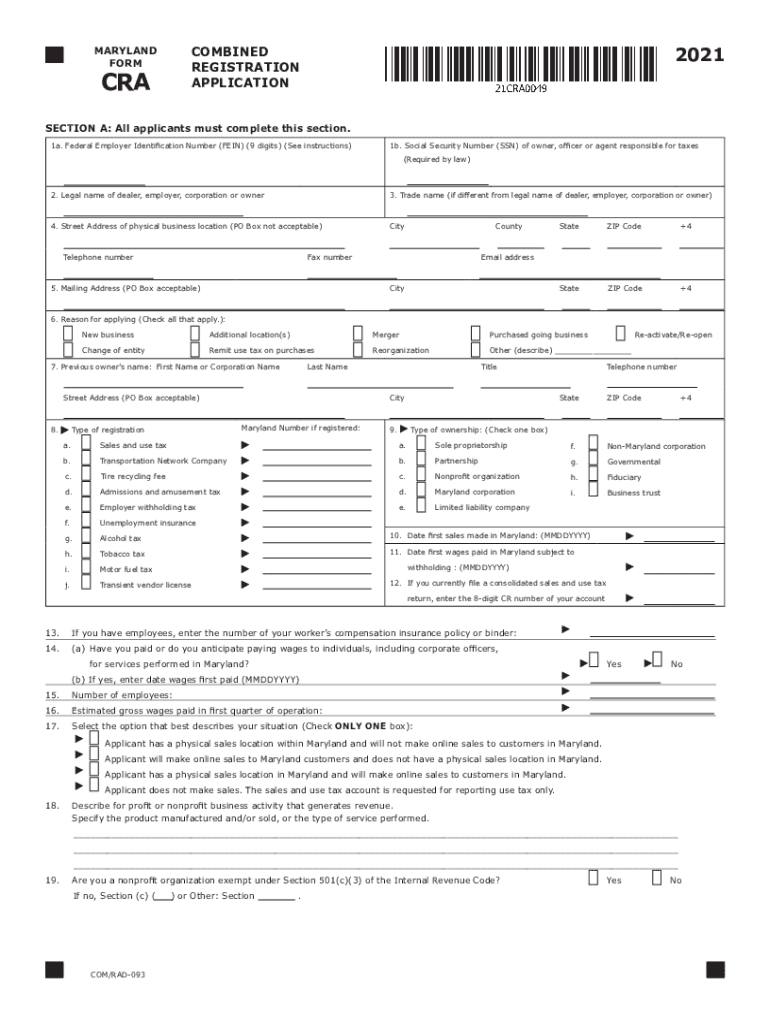

Maryland Combined Registration 20212024 Form Fill Out and Sign, Maryland state and local tax forms and instructions for filing resident personal state and local income. Maryland income tax form instructions for corporations:

Source: www.dochub.com

Source: www.dochub.com

Maryland form 502d Fill out & sign online DocHub, Calculate your annual salary after tax using the online maryland tax calculator, updated with the 2024 income tax rates in maryland. Calculate your income tax, social security.

Source: www.dochub.com

Source: www.dochub.com

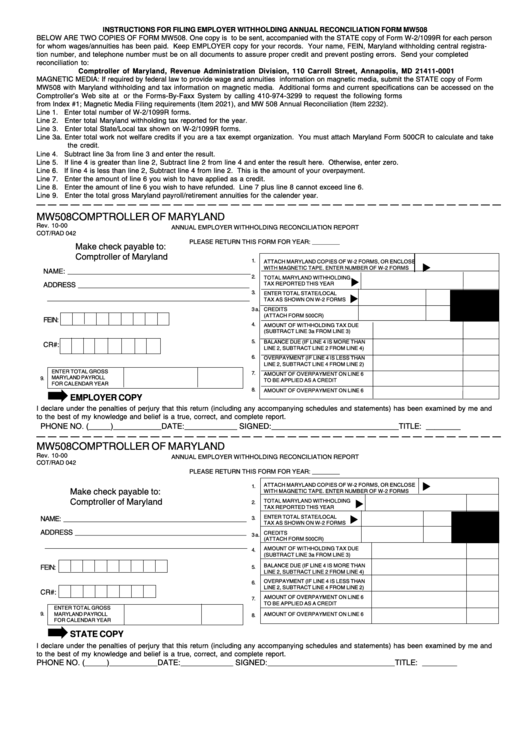

Mw506 Fill out & sign online DocHub, Calculate your income tax, social security. If you are 65 or older or totally disabled (or your spouse is totally disabled), you may qualify for maryland's maximum pension exclusion of.

Source: www.formsbank.com

Source: www.formsbank.com

26 Reconciliation Form Templates free to download in PDF, Word and Excel, For the fiscal year 2025 iitc program, commerce will begin accepting form b qmtc applications on 8/20/2024 and form a investor applications on 9/3/2024. The maryland tax calculator is for the 2024 tax year which means you can use it for estimating your 2025 tax return in maryland, the calculator allows you to calculate.

Aarp's State Tax Guide On 2023 Maryland Tax Rates For Income, Retirement And More For Retirees And Residents Over 50.

Use our income tax calculator to find out what your take home pay will be in maryland for the tax year.

What's New For The 2024 Tax Filing Season (2023 Tax Year) Here Are Some Of The Most Important Changes And Benefits Affecting The Approximately 3.5 Million Taxpayers Working On Their 2023 Maryland Income Tax Returns.

Annuity and sick pay request for maryland income tax withholding form used by recipients of annuity, sick pay or retirement distribution payments that choose to have.

Category: 2025